The first approach - Make money working for money

Most of us are at this stage. We studied hard to earn our certification, diploma or degree and then land ourself in a job with quite a stable salary to give us a decent life. Some are not so fortunate and earn lesser than others so they have a simpler life. But, for these 2 groups of people, life is actually the same. Both are working and earning money through the exchange of time. The person who earned a higher salary may seem to be living a better life with a bigger house and a bigger car but in fact, he or she is no different from the man who earned a lower salary. Why is this so?

Happiness does not come from living a more luxurious life

It has been reported again and again that Singapore, although being a developed nation, has one of the most unhappy people in the world. Our local newspaper, The Straits Times, reported on 20 December that Singaporeans are not only emotionless but unhappy as well. Singaporeans are apparently less upbeat than the people in places like Iraq, Yemen, Afghanistan and Haiti. This is getting quite ridiculous. In the report, the main reasons cited for the negativity was the competitive culture, work pressure and rising cost of living. Are we focusing on making money so much to the extent we lose our happiness?

We do business but still focus on making money

When we can't earn enough from a salaried job, many people start their own business thinking it will give them more money to have a better future. Some work so hard to make their business successful that they neglect their family. They grow cold with their spouse and their children grow up without the love of a family. Before they realise it, it may have been too late to go back in time.

Trading in the stock market

There are also those who think it is easy to earn money from the stock market. Using $1000 to make $10,000? Its becoming a common mindset now. But what is the result? Most people lose money in the stock market, lose their sleep and even their lives. Yes, some people literally commit suicide because they lost too much money from the stock market. Trading in the stock market is also active income. It is a professional job which amateurs should learn the ropes before joining the leagues.

The problem with active income

Now, you might have realised money is not the source of happiness and sacrificing time for money makes it even worse. Having said that, money is not everything but everything we see around us involves money. It would be foolish to say that money is not important.

Most of us climb the corporate ladder to earn a higher pay check. As our salary increases, so does our standard of living.

Our lives evolves from this:

To this:

I'm not against living a luxurious life. But did you know most people's luxurious lives are short lived while a small group of people will be rich forever?

This is why most people's luxurious lives are short lived:

One year later:

Once this high income earner loses his job, he still has to pay for the mortgages for his house and car and other miscellaneous expenses. If we assume his savings to be $24,000, it can only last him for a maximum of 3 months. If he cannot find a job within that period, the consequences will be undesirable.

The above person is having 80% of his income in debt which is very dangerous. That is why the TDSR was introduced to limit all debts to 60% of your income. For the above example, if debt is limited to 60% of his income, his savings would have doubled and can last him more than 6 months. That is the power of just 20% more savings in a year.

You may ask how does the above calculation work out? Assuming the above person is limited by the TDSR of 60%, his debt repayment would only be 6k every month instead of the 8k loan repayment he has now. As such, he would have an extra 2k savings per month which is 24k a year. This brings his total savings to 48k a year which is doubled of his initial savings if he had a 8k loan. That is how with just 20% more savings per month, your savings would have doubled in a year.

Fast forward 30 years later at retirement age, this person would have accumulated a savings of $720,000. But without any investment or passive income, the income could only last him 7.5 years if he stops working. We might say he would have finished paying for the house by then so his expenses would have been lower. Even with a lower expense of $5000, his savings over the 30 years would only last 12 years.

Imagine working for 30 years and your savings could only last you 7.5 or 12 years. That is what happened to a lot of people who took the make money working for money approach.

The Second Approach - Make money letting money work for you

The second approach is what I call the visionary road. Only those who look far ahead will see it. You'll see how a person who take this road will have money that last him a lifetime.

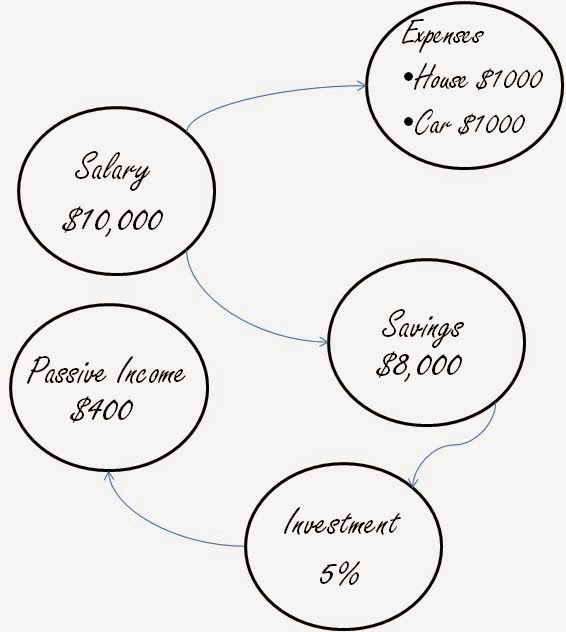

This is how it looks like:

One year later:

This same person loses his job but because of his low expense and high savings ratio, he manage to accumulate a savings of $100,800 which can last him 50 months. This is approximately 4.2 years. Don't forget because this person focuses on letting money work for him, he has steadily achieved a passive income of $420 per month.

The magic happens from here forward. Assuming this person finds another job but earns much lower now than before. He only manage to get a $5000 per month salary.

Let's see what happens in 10 years time.

In 10 years time, this person, although earning a lesser salary at $5000, managed to accumulate a savings of $553,330 through prudent savings and investment at 5% compounded. What he did was to just to invest, get dividends and reinvest the dividends. Within just 10 years, this person has achieved financial independence with $2305 passive income per month. Even if he loses his job, he still can live normally for the rest of his life. He could even choose not to work any more.

Let's move even further to 10 more years ahead:

With consistent savings and investment, this person's passive income more than doubled. Money does work harder for you at a compounded rate.

Key takeaways of the 2 approaches

- High income with high expenses is suicidal

- Money can work for you if you create passive income

- Passive income grows at a compounded rate.

Enjoyed my articles?

or follow me on my Facebook page and get notified about new posts.

Related Posts:

1. Why extreme savings is more powerful than investing

2. Going from working middle class to rich with a simple tweak

0 Response to "The Two Approaches to Making Money"

Post a Comment